Forty Seven Bank — Banking For a Digital Age, Bringing Fiat and Cryptocurrency Under One Roof

Who are we?

Forty

Seven is a unique project built to create a modern universal bank both

for users of cryptocurrencies and adherents of the traditional monetary

system; a bank that will be acknowledged by international financial

organisations; a bank that will correspond to all the requirements of

regulators.

A

team of professionals from the worlds of banking, finance, and IT with

expertise and experience in the creation and licensing of payment

systems, and building of electronic financial institutions will work to

realise the goals of the project.

Our

bank will become the biggest structure that corresponds to all the

requirements of regulators and the EU Payment Services Directive 2

(PSD2). We will comply with Know Your Customer (KYC) and Anti-Money

Laundering (AML) policies in order to guard against agents of the “grey”

market.

The Forty Seven project is founded on three key principles — Relevance, Convenience, and Security.

RELEVANCE

Forty

Seven Bank incorporates and deploys the most up-to-date innovative

technologies available, such as blockchain, biometrics, smart contracts,

and machine learning. This allows Forty Seven Bank to bring all the

services of traditional banking to users of cryptocurrency and bringing

to users of traditional fiat currency all the benefits of disruptive new

technologies.

CONVENIENCE

Forty

Seven Bank introduces the concept of a ‘multi-asset account’ which

gives customers access to and control of both crypto and fiat assets in

one place, through one simple, easy to use interface. While the use of

biometric identification and blockchain allows users ease of access and

the capability to manage multi-asset accounts from anywhere in the world

via smartphone, or ATM and without the need for a card.

SECURITY

Forty

Seven Bank will be recognised by international financial organisations,

and conform to all regulatory protocols and requirements, including the

European Union’s Payment Services Directive 2 (PSD2). The bank will also

be compliant with Know Your Customer (KYC) and Anti-Money Laundering (AML)

policies, guarding against exposure to actors and representatives of

the “grey” market. High-end encryption and biometric ID verification will

be employed to protect and secure the integrity of customers personal

and payment data.

Cryptocurrency

and the technology driving it is changing the infrastructure,

institutions, and processes of banking and will continue to do so over

the coming decades. Forty Seven Bank is a bank tailor-made for this

future, positioned to connect the crypto and fiat markets, unite them

under one roof, and offer customers the best of both worlds with a bank

designed for the digital age.

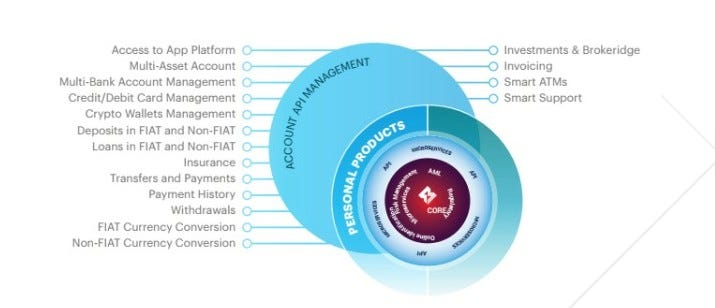

Products and Services

Forty

Seven Bank is aiming to provide broad traditional and digital financial

products and services spectrum for individual clients.

In

the past, Customer Relationship Management (CRM) has changed approach

to the business and customer service.We believe that smart contracts

which are connected to legal and financial banking services will lead to

a new technological revolution.

|

| Figure 1 below presents the range of products and services that will be offered by Forty Seven Bank to private persons. |

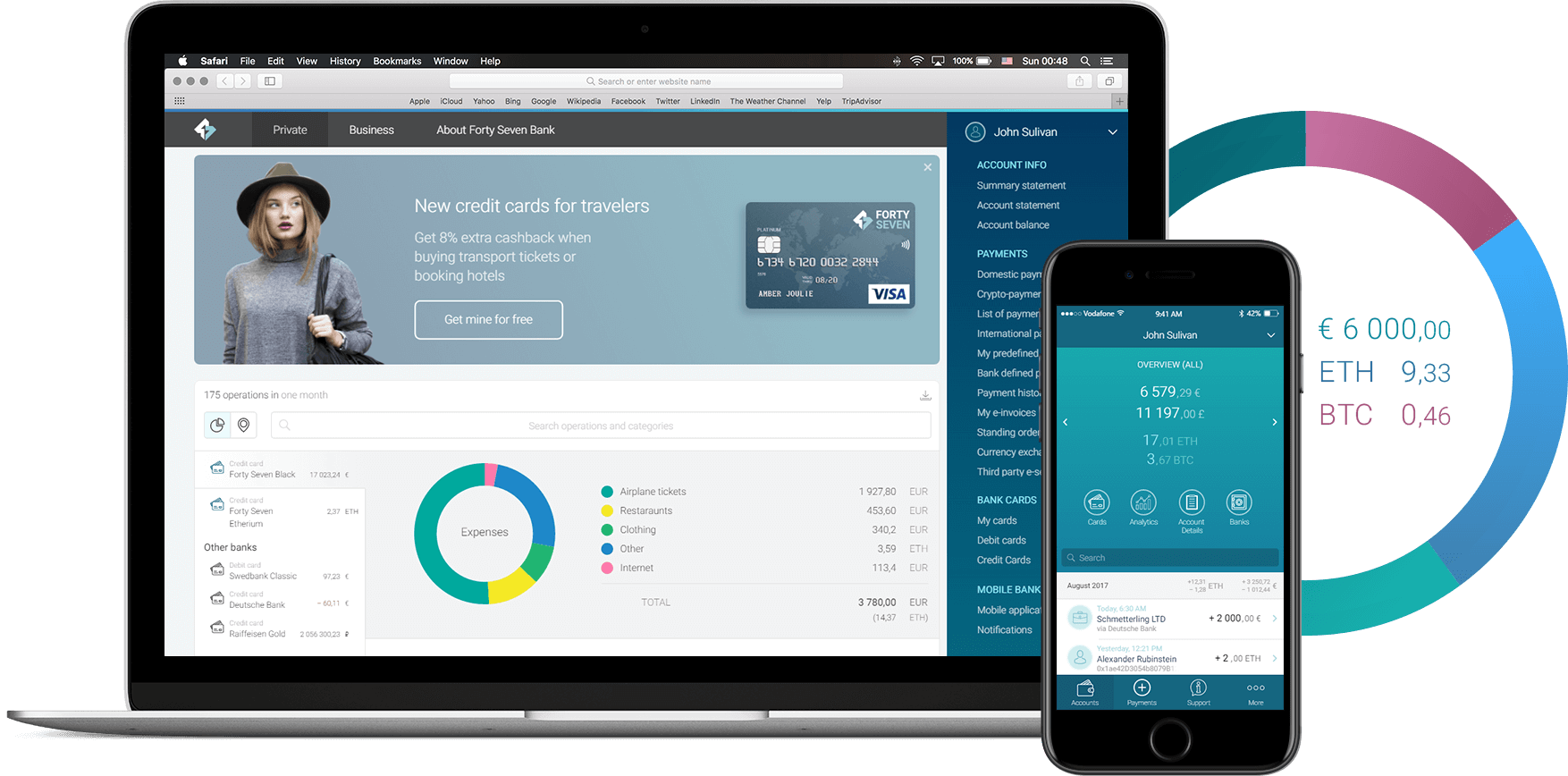

Innovative products for everyone

The featured product is a Multi-Asset Account for private customers with a tied card.

- Remote identification and authorisation based on passport and biometric data

- Unique combination of payment tools — SWIFT, credit and debit cards, e-wallets, secured cryptocurrency payments

- Transactions with any type of cryptocurrency through the bank’s application and with no need to wait for current exchanges. Uploading, withdrawal, and conversion by any pair is available

- Wide range of services including crediting, insuring, invoice presentation, credit/debit card management etc.

- Cross-platform access for clients to manage accounts opened with any European bank that complies with the PSD2 directive

- Convenient and user-friendly UI

- Analysis that helps a client to make the right financial decisions via services of a personal manager created on the basis of machine learning algorithms

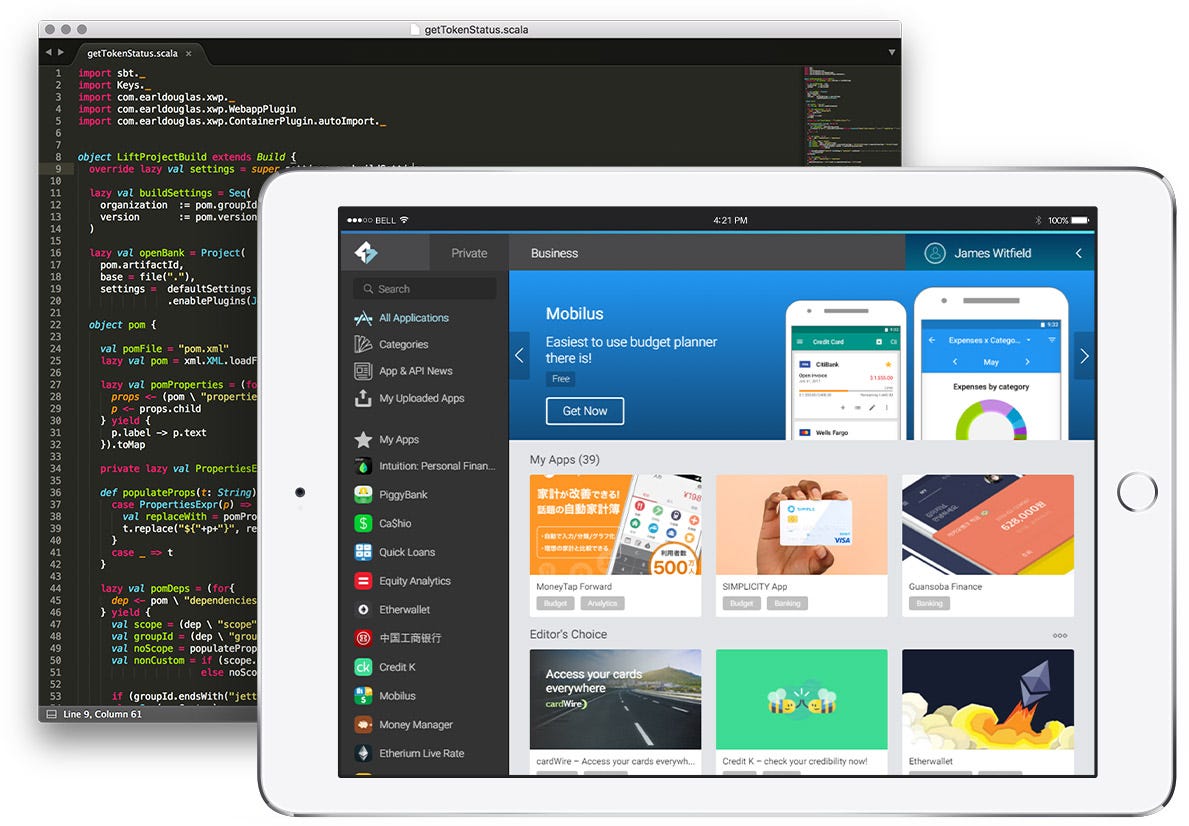

Propositions for business

Business products oriented towards small and medium-sized enterprises.

- Managing an account via Application Programming Interface (API), creation of financial applications

- Receiving payments from a merchant in both cryptocurrencies and in fiat money on the company’s account (card, SWIFT) using a form or API

- Mass payouts for marketplaces

- Loyalty management for clients using big data

- Factoring services based on the operation of machine learning and big data (artificially intelligent algorithms able to predict the probability of repayment of credit as well as timeliness of repayment from a company)

- Escrow services

- Mobile application with biometric identification for multi-currency transactions

Tools and services for external developers

- Opportunity to provide Forty Seven banking services under your own brand (white label)

- API access that allows the development and implementation of modern financial services based on Forty Seven infrastructure and processes

- Holding DevDays conferences for independent developers

- A showcase of financial applications using Forty Seven API

Features of the Forty Seven Bank platform

A

side from the three core principles, the platform also incorporates and

deploys the most up-to-date innovative technologies available right now

such as blockchain, biometrics, smart contracts, and even machine

learning!

All

of this comes together to allow Forty Seven Bank to provide services of

traditional banking to users of cryptocurrency as well as showing the

benefits of digital assets to users who may not know much about it.

Easy cryptocurrency trades and exchanges

A great feature of the platform is that cryptocurrency transactions can happen within a bank’s application.

By

using mobile applications, Forty Seven Bank’s clients will be able to

buy and sell any type of digital currency at a bank’s internal exchange

with low fees and an extremely short waiting time.

This also includes conversion from cryptocurrencies to fiat or vice versa–like an exchange.

Access to multi-asset accounts

Forty

Seven Bank also provides users a multi-asset account which gives

customers access to and control of both cryptocurrency and fiat assets

in one place, through an easy to use and intuitive interface.

The

application of biometric identification combined with the blockchain

allows users the ease of access and the capability to their manage

multi-asset accounts. This can happen from anywhere in the world with

only a smartphone or ATM and without the need for a physical card.

Use cryptocurrencies like real money

Forty

Seven Bank’s merchant payment services enable clients to start

accepting money on cryptocurrency accounts, cards, or via SWIFT

transactions.

With the API, businesses will also be able to transfer crypto assets to their company’s account easily.

This

feature is further extended with the ability to accept cryptocurrency

payments from buyers in online-stores, on websites, or even mobile

applications which are all set up without any hassles.

Funds

transferred in cryptocurrencies will automatically be exchanged at a

selected bank’s internal exchange rate and accredited to the business’

account in fiat.

Legally compliant

As

mentioned earlier, the bank is fully compliant with Know Your Customer

(KYC) and Anti-Money Laundering (AML) policies which guards the

ecosystem against shady operators as well as frauds or scams.

Forty

Seven Bank will also include high-end encryption and biometric ID

verification to protect and secure the integrity of personal and

sensitive data of users on the platform.

The Forty Seven Bank token sale

Here are the details of the upcoming Forty Seven Bank token sale:

Token name: FSBT

Token base: Ethereum (ERC-20 compliant)

Token supply: 55,319,149

Token sale duration: 16th November, 2017–16th December, 2017

Token sale target: 180,000 ETH (hard cap)

Token exchange rate: 1 FSBT = 0.0047 ETH

Token Distribution

TEAM

Advisors

Details Information :

Komentar

Posting Komentar