PayPro — The First Decentralized Bank

History PayPro

PayPro was born in 2015 as an online tool for making payments in 25

currencies saving up to 90% on hidden bank fees. We got regulated by the Financial Conduct Authority, raised two funding rounds of €750,000 in total and spent a little bit more than a year in the market. We managed to process € 500,000 per month, which is not bad at all compared to the early beginnings of Kantox or Transferwise, for instance.

From that experience, we soon learned that the payments / banking industry was totally outdated. Thus, we soon realized that we had to make a step forward if we wanted offer a truly disruptive value proposition if we wanted to change the industry. This is why we started to listen to the market, talk with industry’s experts and do a lot of test and fail. And this is how we created PayPro: the first decentralized bank built.

About PayPro

PayPro is a financial marketplace where any Decentralized Application (dApp) will be able to offer its services. Thus, dApps will be competing among them to become your supplier, not the other way around as with banks.

In order to accomplish this goal, we are building first a universal wallet that will be capable to store most popular crypto-currencies and any ERC-20 token. As soon as we have released the wallet, we will build the marketplace.

What is DAPP?

PayPro’s commercial center will work as a decentralized app, also known as dApp. As per David Jonhston, a dApp must meet several criteria to consider for all things to consider:

=> Applications must be produced open source, need to work by itself and the larger token part can not be controlled by the elements. In addition, proposed upgrades and market criticisms may be adjusted in the convention.

=> keeping in mind the ultimate goal of obtaining an application and to compensate for award commitments from miners or customers, a cryptographic token is essential.

Decentralized application

PayPro’s marketplace will be built as a decentralized application, also known as dApp. According to David Jonhston, a dApp must meet some criteria in order to be considered as such:

=> The application must be developed open-source, it has to operate autonomously and the majority of tokens can not be controlled by an

entity. Also, proposed improvements and market feedback may be

adapted in the protocol.

=> In order to access the application and to reward any contribution of value from miners or contributors, a cryptographic token is necessary

The Product

We understand that the core functionality of PayPro has to be its capacity to store currency-value and spend it. Otherwise there is no point of storing value if it can not be used. For that reason, we have built the banking platform first.

Wallet

PayPro will accept most forms of cryptocurrencies. Using Ethereum will allow users to store at least the 100 most used currencies by transaction volume per day. Of course, PayPro Token will be our main currency and will be easily exchanged with any other currency.

So far, we have developed an iOS app that allows to store BTC, but this is just a proof of concept made for user experience purposes. You can download it on the AppStore here: https://itunes.apple.com/us/app/paypro/id1225181484?l=ca&ls=1&mt=8

How PayPro Works ?

=> Review

Please, review our white paper and understand the terms of investment. Do not hesitate to contact us if you have any queries.

=> Whitelist

In order to be able to join our ICO, it is mandatory for us that you fill our know-your-customer form.

=> Agreement

Send your ETH from your MyEtherWallet, not an exchange. Once the campaign is closed, we will send you your tokens.

=> Future

In a future where Smart Contracts will be used for many of our daily activities, such as using decentralized computer power, trading or insuring a car, we believe that banking is also going to be decentralized.

As a result, if our marketplace manages to gather a universal crypto-wallet and a financial marketplace in the same place, we will have created the first decentralized bank-alike application where users will be capable of storing and managing all their crypto assets, ranging from storing currencies, loans or investments.

PayPro Token detail:

The PayPro Token is normally referred as PYP. The PayPro will be used by anyone in the world except the individual who lives in the Singapore, the Estonia, and the US because of the legal restrictions of the country or the countries trade certified by the US. The PayPro will not accept the ETH currency. The Pre-sale of the PYP starts from 8th, January 2017 and end on 15th, January 2017. The exchange rate of the PYP is 500 PYP is equal to 1 ETH. The hard cap of the PayPro is 20,000 ETHS or 5,000,000 EUR.

Token Sale Summary

Name PayPro Token

Symbol PYP

Pre-sale period January 8th to January 15th, 2017

Pre-sale terms Min investment of 15 ETH

Pre-sale bonus Bonus of up to 35%

Main Sale period January 15th to January 31st

Main sale terms Min investment of 0.5 ETH

Main sale bonus 1st 24 hours 20%

1st week 15%

2nd week 10%

Exchange rate 1 ETH : 500 PYP

Limits 20,000 ETH (Hard Cap) or EUR 5,000,000.00

depending on exchange rate.

Accepted currencies ETH only

Token holder benefits Decision & Economic rights.

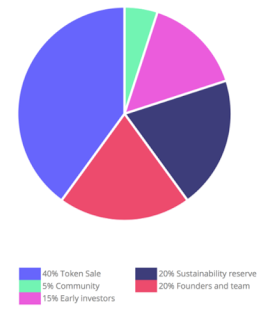

% of Token sold 40%

Nationality Anyone except Singapore, Estonia and the US due to legal restrictions or countries trade sanctioned by the US.

Allocation

Team

Details Information :

Website : http://www.payproapp.com/

ANN Thread : https://bitcointalk.org/index.php?topic=2460780

Facebook : https://www.facebook.com/thepaypro

Twitter : https://twitter.com/thepaypro

Telegram : https://t.me/share/url?url=t.me/payproico

My Profile Bitcointalk : https://bitcointalk.org/index.php?action=profile;u=1305006

Komentar

Posting Komentar